Port Authorities Chart a Course Toward Electrification

The nation’s ports are essential to the economy and vital components of the supply chain ecosystem. Operating around-the-clock, port activities are also responsible for a significant source of local air pollution and climate-warming emissions.

To address growing environmental concerns, port authorities across the country are undertaking ambitious projects to electrify their shipping and cargo-handling activities. Electrification offers a pathway to comply with emerging state regulations and creates opportunities to tap new sources of federal funding.

Improvements in on-shore power systems, hybrid-electric equipment, and battery technologies make electrification more financially and logistically practical than ever before. Still, replacing diesel-fired equipment will require major overhauls of critical equipment, presenting one of the greatest infrastructure challenges since construction of the first container ports over a half century ago.

Clearing the Air

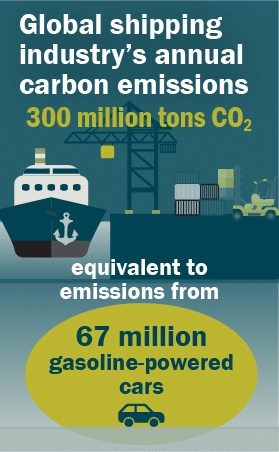

The maritime shipping industry is responsible for roughly 3 percent of global carbon emissions. With shipping volumes on the rise, the industry’s carbon footprint is forecast to grow by as much as 4 percent, year after year, according to the U.S. Environmental Protection Agency.

Near-port communities are frequently affected by high levels of particulate matter, nitrogen oxides, carbon monoxide, and sulfur oxides. This legacy of air pollution has had a disproportionate impact on low-income residents and people of color.

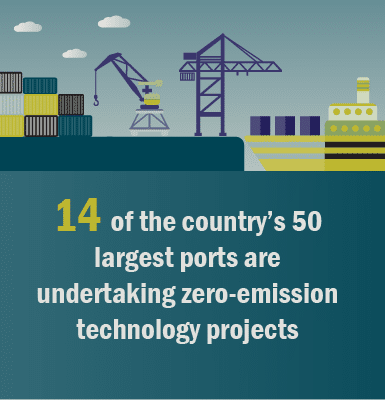

In response, port terminals are pursuing programs to reduce emissions from diesel engines and other pollution sources. Nearly a dozen U.S. ports have made climate or air quality commitments.

For some, the move toward electrification is a requirement. In California, port authorities and shipping companies are preparing for a wave of transformational mandates:

- As of May 2023, every docked shipping vessel must rely on electricity rather than diesel engines to power on-ship equipment.

- Beginning January 2024, drayage truck operators must transition to zero-emission vehicle technology.

- Looking ahead to 2026, proposed regulations would require zero-emission container handling equipment

Just in time, new funding is available to support zero-emission projects. Adding to the mix of federal, state, local and utility funding, the Inflation Reduction Act of 2022 allocated $3 billion for port facilities to purchase or install zero-emission equipment.

Paths Forward: Multiple Electrification Options

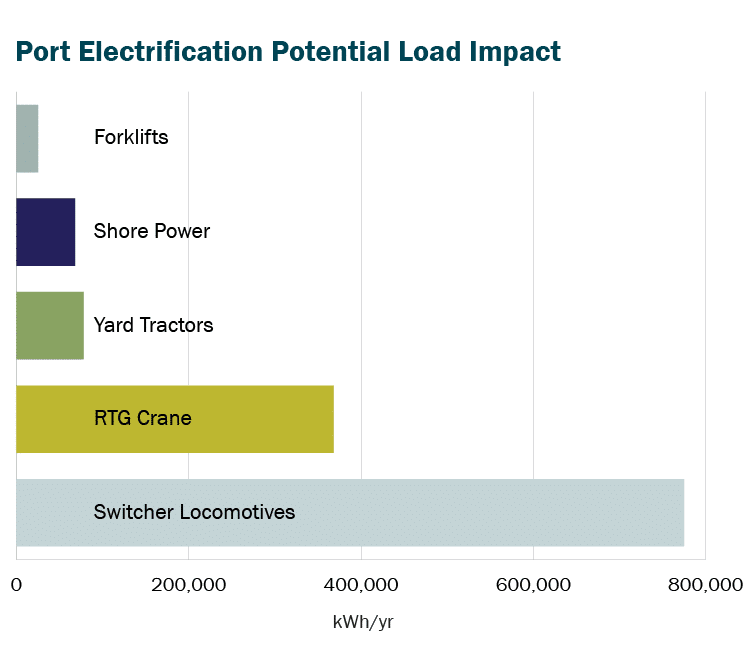

If a port’s electrical capacity can accommodate adding large sources of demand, many different types of infrastructure could potentially go electric.

An initial step is to determine whether existing equipment can be retrofitted or if new electrified equipment needs to be purchased. A comprehensive assessment reviews the infrastructure’s state of repair and includes a cost-benefit analysis of each upgrade option.

The following are examples of electrification projects currently underway across the country.

![]() Shore Power

Shore Power

Shore-supplied electricity replaces consumption of bunker fuel while ships are docked in port, avoiding release of diesel-engine emissions. Ships are retrofitted with power supply boards, using onshore supplies to power vessel lighting, refrigeration, air conditioning, and other equipment.

Also known as “cold ironing” or alternative maritime power (AMP), shore power was first instituted decades ago by the U.S. Navy, lowering fuel costs and reducing wear and tear on ship equipment.

As of 2022, a dozen U.S. ports had installed or planned installations of medium-voltage systems capable of powering cruise, container, or refrigerated vessels. Several more ports are providing low-voltage systems for tugs, fishing boats, and offshore support vessels.

![]() Electric Gantry Cranes

Electric Gantry Cranes

Mounted gantry cranes move on rails or rubber tires to stack and move containers around the terminal. Diesel-powered cranes often operate around the clock, accounting for up to half of a port’s total fuel consumption. Many still rely on decades-old engines that do not conform with modern efficiency standards.

Electric gantries use cable systems or diesel-electric power packs. The electric cable reel system or electric hybrid drives can significantly lower energy costs and reduce diesel emissions. The Port of Savannah, for example, electrified 27 diesel cranes, reducing operating costs by 85 percent.

![]() Cargo Handling Equipment

Cargo Handling Equipment

Trucks and other cargo handling equipment are potentially well suited for electrification. Drayage trucks, for example, carry containers from ports to nearby warehouses. When stationary, the trucks can spend 10 percent of their diesel fuel while idling, according to a U.S. National Renewable Energy Laboratory study. That’s time that could instead be spent charging batteries. Electrify America has plans to build 20 charging stations at the Port of Long Beach, powering a 60-vehicle fleet of electric drayage trucks.

Opportunities exist to electrify additional types of cargo handling equipment. Battery-electric or fuel cell powered alternatives are presently available for:

- Terminal tractors

- Forklifts

- Material handlers

- Mobile cranes

- Reach stackers

- Side handlers

- Straddle carriers

- Top handlers

![]() Battery-Electric Maritime Vessels

Battery-Electric Maritime Vessels

Pilot projects are exploring the feasibility of fully electric or hybrid diesel-electric ships. Battery-powered propulsion may not yet be practical for long-distance cargo vessels. For short distances, however, electrification can offer greater efficiencies.

Zero-emission alternatives are available for tugs, towboats, and passenger ferries. The Port of San Diego plans to commission an 82-foot, battery-electric tug boat in 2023.

Into Ship Shape: Port Infrastructure Challenges

Ports rely on critical infrastructure to maintain 24/7 productivity, uphold the highest safety standards, and effectively manage operating costs. Port electrification will require significant investments in electrical infrastructure upgrades as well as sitework to accommodate new charging or power-supply systems.

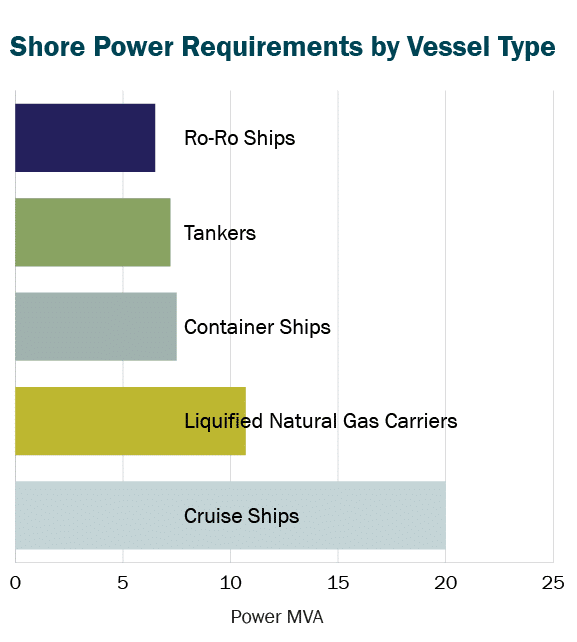

Electrical Design

Many ports lack appropriate infrastructure to connect ships, trucks, and other cargo handling equipment with power sources. Electrical power systems may need to be supplemented with new substations, dedicated transformers, and switchgear. Distribution systems will need to accommodate power requirements for each type of electrified equipment, vehicle or vessel — with customized solutions to address unique voltage and loads.

To ensure the critical safety of electrical designs, the engineering team must adapt stringent Occupational Safety and Health Administration (OSHA) requirements for waterfront facilities, all while remaining abreast of evolving standards for charging and power-management systems. Waterfront locations expose electrical components to salty air or other caustic conditions, requiring more frequent maintenance.

Cable Management

Port operators must have flexibility to move electric-powered equipment throughout the port or along the shipping berth. A cable management system (CMS) needs to take into consideration the facility’s operational requirements and structural systems. Changing technology standards, ever-increasing vessel sizes, and active terminals’ construction limitations all create additional challenges.

CMS options include building a trench-based cable reel system, overhead conductor systems, or mounted cables installed on mobile equipment. One innovative shore power system uses a self-propelled, chain-based technology that rides on the quay wall, positioning the outlet anywhere along the berth.

Source: ICF International Inc.

Utility Upgrades

Growing demand for power capacity presents perhaps the mostly costly infrastructure challenge. Many ports were built without much more power than whatever was necessary to keep lights on and the guard station equipped. Moving forward, megawatts of power demand will be needed to support shoreside and maritime systems. Terminal operations and peak grid demand typically overlap, resulting in demand charges that further escalate operating costs.

Grid upgrades are expensive and take years to complete. Close coordination among port operators and tenants will be essential to accurately forecast total demand. Even if the local utility can supply extra capacity, reliability is a concern as extreme weather events make power outages more common.

Port authorities are exploring installation of distributed energy resources. Ports can integrate solar photovoltaics (PV), fuel cells, and battery energy storage systems — connected by a microgrid — that add power supply to match their facility’s planned load growth. Distributed energy resources can reduce utility expenses, shift consumption to off-peak times, and bolster port resiliency.

Source: McKinsey & Company

Quieter, Cleaner, and Busier than Ever

Ports have to balance competing priorities. As public entities, ports are being asked to address their environmental impact. At the same time, ports are run as corporate entities. Authorities are responsible for maximizing financial competitiveness and avoiding any risks to shipping operations.

Up until now, this tension tethered ports to fossil fuels. New regulations, corporate social responsibility initiatives, and rising diesel and fuel oil costs are aligning the priorities of port authorities and their stakeholders, making electrification an increasingly attractive solution.

Ports of the past were busy, noisy, dirty facilities. Looking ahead, as more equipment goes electric, ports will stand as leading examples of how authorities can undertake cost-effective actions to become environmental stewards and responsible community partners.